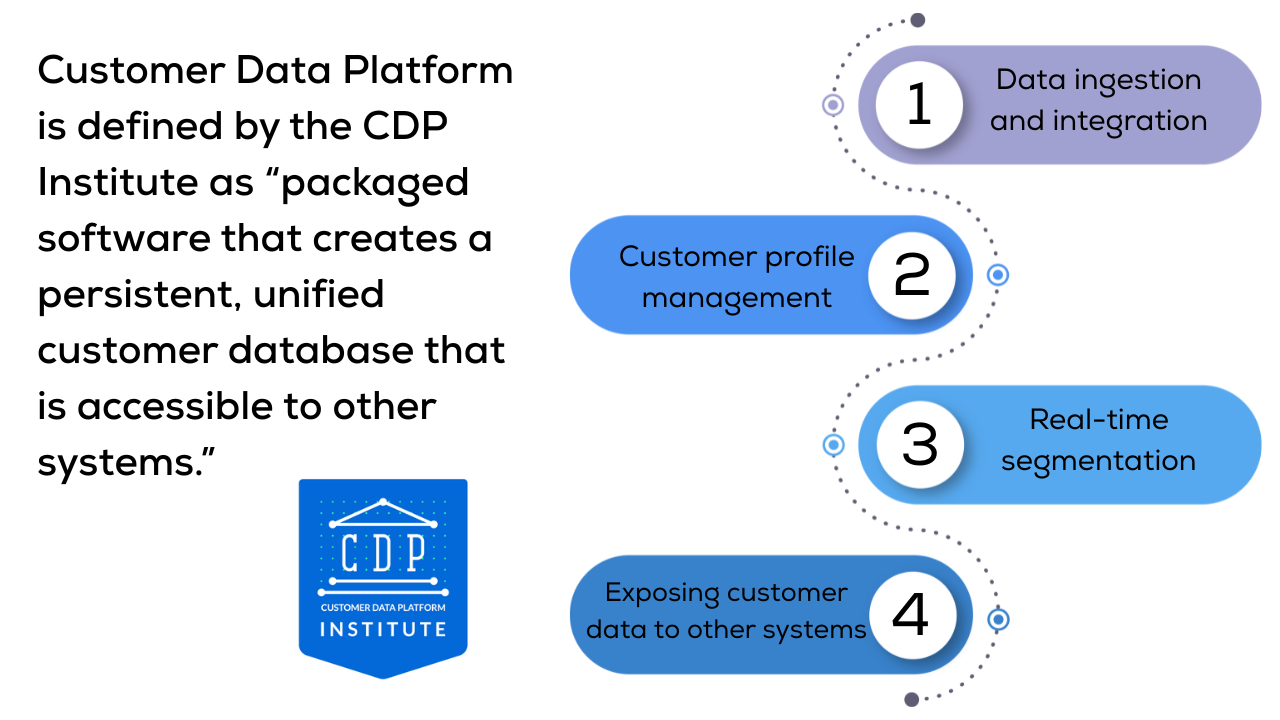

If you follow the CDP Institute’s definition, there are four non-negotiable traits for a platform to be considered a Customer Data Platform. But there’s a huge problem. Those traits are no longer exclusive to CDPs. Customer Engagement Platforms like Braze, Bloomreach, Customer.io, Klaviyo, and ZEPIC, or composable vendors like Hightouch, are ticking the same boxes. Some were never meant to be in the CDP category, yet they’re already competing for the same budget lines.

It’s too late to say that it is purely theoretical. We have already crossed that bridge. It’s what I see in real RFPs and platform migrations. Clients weighing an AI Decisioning-first CEP against a so-called Leader in the Gartner Magic Quadrant. If the outcomes are similar, the definition starts to matter less. And when definitions become elastic, quadrants lose their sharpness.

The invisible layer of competition

In part 1 of this series “Is it all a magical illusion?”, we looked at the disconnect between Gartner’s Magic Quadrant for CDPs and how real-world teams experience these platforms. Peer Insights painted a very different picture, not perfect, but far closer to the day-to-day truth. The missing piece? Many vendors shaping the customer data space aren’t even in that Magic Quadrant.

Some of this invisibility is by design, some of it, in my honest opinion, is bureaucratic. The Magic Quadrant, as I stated in part 1, is built to evaluate a defined market category, and it rewards scale, stability, and enterprise polish. That’s why suite vendors like Adobe, Salesforce, and Oracle show up year after year. But it also means that players who innovate around the edges, whether it’s reverse ETL, AI-powered identity, or CEP-driven orchestration, often remain off the radar.

When you speak with teams who’ve switched from a suite-based CDP to a CEP with CDP-like capabilities, they’re not talking about missing out on a quadrant position. They’re talking about cost savings, faster iteration, and better integration with the rest of their stack. I’ve seen this shift play out in both European enterprise migrations and mid-market adoption in the Middle East.

The architecture vs. usage problem

Here’s where the conversation needs to evolve, if there is still time. The Magic Quadrant, by design, is architecture-centric. It’s about what the platform can do in theory, not necessarily what it will do in your environment with your team and governance in place. That’s why the Leaders box can be full of platforms that, once deployed, fail to deliver the agility or operational fit customers actually need.

This is something I touched on in the multi-CDP series: ownership, governance, and workflow fit determine far more about success than category alignment. In practice, the question isn’t

“What architecture is best?”

but rather

“What architecture do we have the people, process, and operational maturity to make work?”

The missing perspective in Magic Quadrant scoring

One of the recurring points in my conversations with industry peers, including a recent discussion with a major vendor (that actively works for its placement in the quadrant), is that while the Magic Quadrant is useful for understanding enterprise-scale capability, it’s not weighted to reflect mid-market priorities or regional buying patterns. That’s a blind spot worth calling out, even if it is just by me.

A CMO in the UAE choosing a CDP to anchor a retail media network is making a fundamentally different set of trade-offs than a global bank’s marketing operations lead in London. Yet the scoring doesn’t reflect that diversity of decision-making. The result? The Magic Quadrant can unintentionally reinforce a one-size-fits-all perception that doesn’t hold up in real operations.

A live example of sentiment shifting, even beyond culture

Ironically enough, Juan Mendoza, CEO of The Martech Weekly, recently posted on LinkedIn about reading the life story of Gideon Gartner, just as Gartner’s stock was taking a sharp dive (I had no idea part 1 of this series would have such an effect, just kidding, I hope…). In his post, he reflects on how the company was once groundbreaking in its ability to analyse the market from the perspectives of investors, customers, and vendors, but is now struggling to stay relevant in an AI-driven, information-saturated era.

He notes how younger Martech executives are starting to say things like:

"Who's Gartner?"

"This MQ doesn’t help my technology decisions."

"I haven’t read a Gartner report in years."

The post is a real-time observation that even the most established names in tech advisory are no longer guaranteed influence. It’s a reminder that the disconnect we’re seeing in the CDP Magic Quadrant isn’t an isolated case. It’s part of a broader pattern where industry authority is being tested in public, and in some cases, in the stock market too.

Where we go from here

If part 1 was about showing the gap between analyst-driven rankings and practitioner experience, part 2 is about recognising that the real competitive map is bigger than the Magic Quadrant. That includes CEPs, composable vendors, and emerging players whose innovation is often invisible to the quadrant, but not to the teams using them.

I’m not arguing that Gartner’s Magic Quadrant should suddenly open the floodgates and throw every tangential player into the mix. But if we’re serious about giving buyers a tool that reflects the market they actually operate in, the scope needs to evolve. That could mean, for instance:

- supplementing the Magic Quadrant with architecture-agnostic usage maps

- making regional weighting part of the scoring

- acknowledging where category lines have blurred to the point of irrelevance

The alternative is to keep using a map that shows the biggest cities and misses the fastest-growing towns. Which, if you’ve been following the CDP Reboot or multi-CDP discussions, is exactly how categories start to lose their relevance.

Read the other parts in this Rethinking the Quadrant series

If you like what you are reading and want to be notified when the final part in this Gartner Magic Quadrant for CDPs series drop, subscribe for free below 👇🏻

Discussion