Gartner released its 2025 Voice of the Customer report for CDPs at the end of August, and, well, I don’t want to say I told you so, “this was identified early on as a likely outcome”.

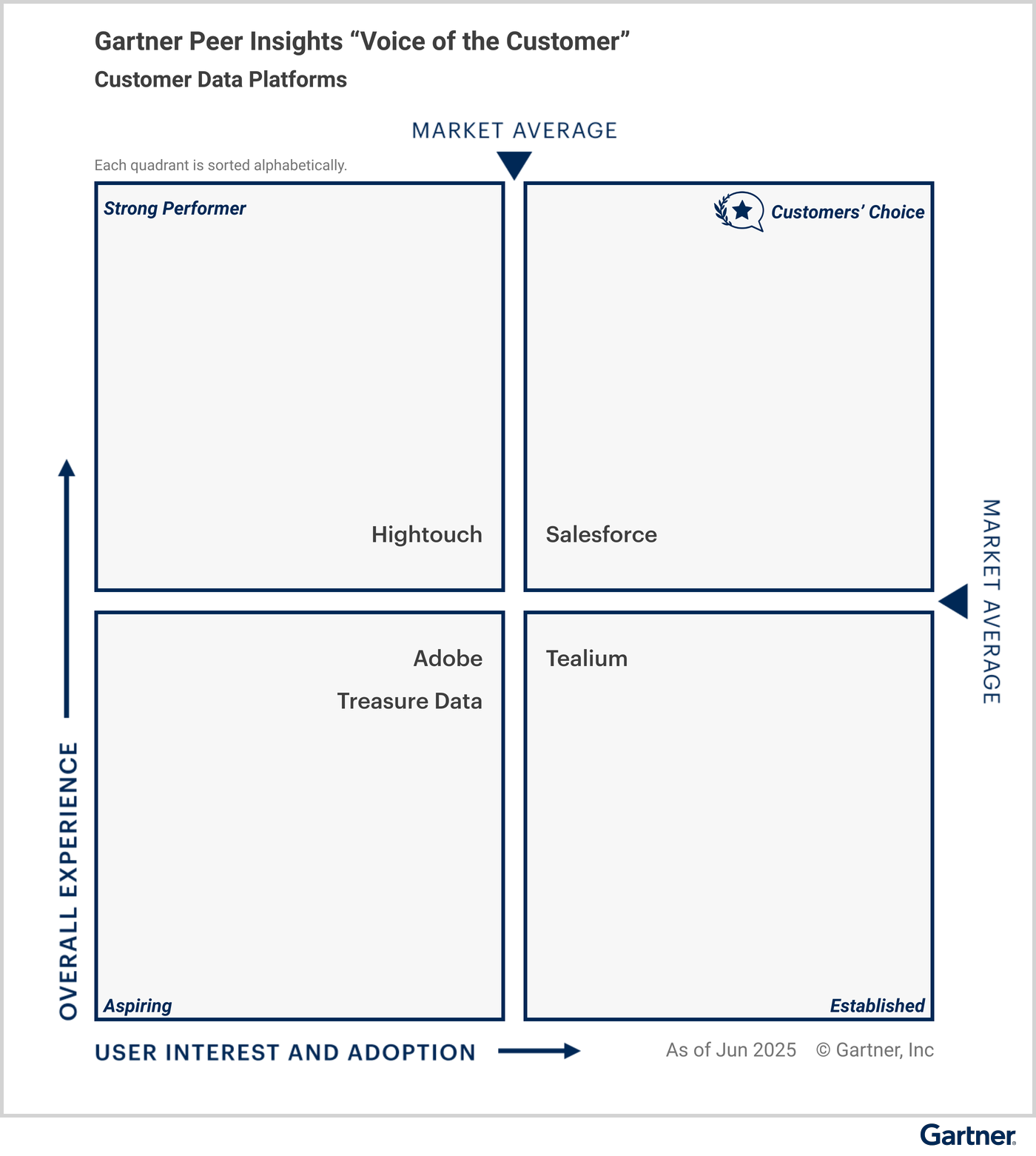

As I suggested in my earlier pieces on Gartner and the CDP market, where, based on Peer Insights, I generated a ‘review-driven’ alternative quadant, Hightouch scored a ‘Leader’ position compared to being completely excluded from the original report.

Based on the newly published official ‘review-driven’ quadrant, Hightouch has now earned a Strong Performer recognition. It’s always interesting when predictions line up with reality, especially when the validation comes from customers rather than analysts.

We all know the weight analyst reports carry. The Magic Quadrant remains one of the most influential documents in Martech. Vendors chase it, execs lean on it, and shortlists are often built straight from the grid. But as I’ve written before, these reports tend to narrow the field, sometimes to the point where buyers forget there are other viable options.

The Voice of the Customer report flips the script. Instead of analyst framing, it draws from Gartner Peer Insights reviews, which are based on the experiences of people who actually use the technology day in and day out. And surprise, surprise, customers don’t always agree with the analysts. Some vendors left out of the Magic Quadrant altogether end up shining here, with reviews that highlight real satisfaction and value delivery.

Now, a key nuance to keep in mind is that vendors don’t appear in the Voice of the Customer simply because Gartner analysts chose to exclude them. According to their publicly available methodology, there are thresholds. To qualify, vendors need at least 20 eligible reviews (with 15 or more capability and support ratings) from companies above $50M in revenue over an 18-month window. If you don’t hit that bar, you don’t show up, regardless of customer sentiment. This is why the Voice of Customer should be read as a peer-based snapshot, not a census of the entire market.

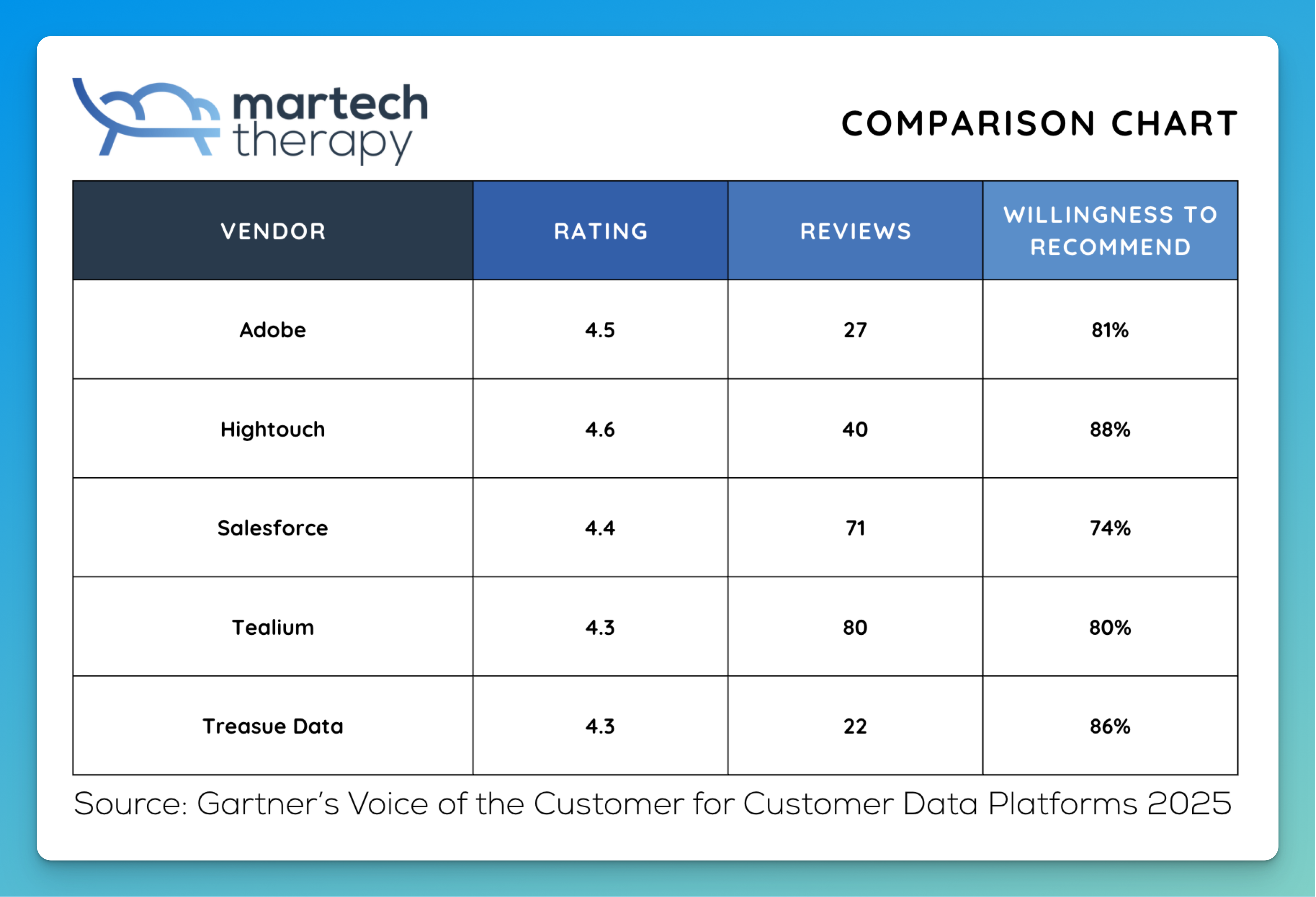

When looking at the scores, it does raise questions about why Salesforce is recognized as the ‘Customers’ Choice.’ Do 31 more reviews really outweigh a 12‑point gap in willingness to recommend? From experience working with qualitative data, I’d argue they shouldn’t. That’s my main point of contention with this report and one I wish Gartner would clarify.

And that tension is exactly what makes Hightouch’s Strong Performer recognition notable. By Gartner’s methodology, Strong Performer means scoring above the market average on Overall Experience (a composite of overall rating, capabilities, and support) but below average on User Interest and Adoption. In Hightouch’s case, that lower placement is driven largely by review volume and breadth across industries and regions, despite having the highest willingness to recommend score among peers. In other words, the customers they do have rate them highly, even if their footprint is smaller than the big incumbents. That nuance matters.

I’ve seen it play out too many times, still to this very day. Companies selecting a CDP based solely on a Magic Quadrant placement, only to end up with a misfit for their data models and team maturity. I’ll admit, Voice of the Customer reports aren’t perfect, reviews are self-selected (confirmation bias), and recent ones carry more weight, but they bring a badly needed counterweight. They remind us to listen to peers, not just to analysts.

So no, this isn’t about cheerleading a single vendor. It’s about acknowledging that there needs to be a balance. Analyst views will always, well, at least for now, shape the category, but customer sentiment tells us where the real wins are happening. And when the two diverge, as they just did with Hightouch, and Treasure Data for that matter, it’s worth paying attention.

Want to read more about my opinions on Martech and CDPs, more specifically? Make sure to subscribe for free 👇🏻

Discussion