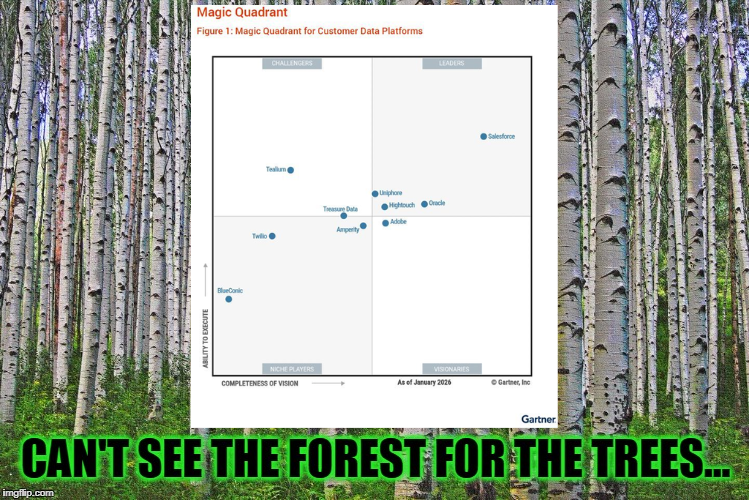

In last week's part 1, I described how Gartner finally named the split inside the CDP category in their Magic Quadrant for Customer Data Platforms 2026. Platformization on one side. Agentification on the other.

Two futures, both serious, both demanding.

That still leaves a simple question hanging:

Who is this actually built for?

Because when you read this year’s Magic Quadrant carefully, the most telling signal isn’t who moved up or down, which opens another can of worms. It’s the kind of organization the category quietly assumes as the norm.

Large teams. Strong data foundations. Time to experiment. Budget to absorb friction. A tolerance for gravity once a platform choice is made.

Where does that leave everyone else?

A pattern you’ve probably seen yourself

At this point, the usual explanations tend to show up.

- The team wasn’t ready.

- The CDP wasn’t implemented “properly.”

- The use cases weren’t ambitious enough.

Have you noticed how familiar that story sounds, regardless of vendor?

In practice, what I’ve seen over the last few years looks less dramatic. CDP projects don’t usually crash. They slow down. The platform becomes something teams negotiate around rather than build on. I'd bet that there are more discussions about which Star Wars movie was the best (Rogue One, of course 😉) than there are about leveraging the CDP more.

Why does stagnation happen so consistently?

Often, it’s because the assumptions behind the platform quietly exceed what the organization can carry. Small data teams supporting many stakeholders. Marketing teams expected to self-serve while also keeping campaigns running. Leadership that wants results this quarter, not optionality three years out.

Those constraints aren’t new, neither are the disappointments. What’s new is that the CDP category stopped flexing around them.

Platformization, seen from closer to the ground

At enterprise scale, platformization makes a lot of sense.

A shared customer model. Governance built in. Brand native connections across marketing, sales, service, and analytics. Once everything is in place, things tend to hold together. True ecosystems.

But what does that look like a level down?

Platformization assumes commitment. More modules. More dependencies. More alignment across teams that don’t always move at the same speed or priorities. Choosing the CDP becomes an operating decision, not just a tooling one.

For some organizations, that’s exactly what they want. For others, especially in the mid-market, the weight shows up quickly. Progress slows. Decisions get harder. The platform starts to shape the organization more than the other way around.

Gravity towards platformization is interesting until you realise how hard it is to change direction.

Agentification sounds lighter, until you look at the fine print

Agentification is often framed as the antidote to that gravity.

Smaller core. More autonomy. Let agents make decisions while humans set direction.

On paper, vendors in the 'agent/agentic' space make it sound so attractive. Gartner clearly treats this as a real trajectory. In all fairness, this is a good outlook, mostly for enterprises, but not a mirror of the present moment... for the mid-market.

In practice, it comes with its own demands.

Agentic systems, and AI applications in general, rely on clean data, clear ownership, and teams that trust automation without disengaging from it. When something goes wrong, someone still needs to know where to look. Was it the data? The logic? The model? The activation layer?

So the work doesn’t disappear. It moves.

This is why earlier signals, like the Gartner Peer Reviews–based MQ simulation I shared before this year’s quadrant, were interesting to me, because they hinted at which operating models buyers were already prepared to support.

Why the middle starts to wobble

For a long time, CDPs occupied a middle ground that mattered, especially for mid-market teams: structured enough to improve data use, but forgiving enough to work without enterprise-level readiness.

A sense of progress without rewriting the organization.

That space is getting harder to sustain.

Platform-led approaches raise the floor.

Agent-led approaches raise expectations.

Pricing models expose inefficiencies faster.

AI features demand better inputs.

Governance stops being optional once automation increases.

Yes, I think that pretty much covers it, don't you think?

What used to feel workable now feels fragile. The margin for being “almost ready” just shrank. Heck, maybe just disappeared altogether.

A quick pause on what the quadrant shows, and what it doesn’t

One thing that often gets lost in Magic Quadrant discussions is scope.

The Magic Quadrant doesn’t show the whole market. It shows the part of the market that fits Gartner’s criteria and participates fully in the process. Some vendors opt out. Others matter architecturally but don’t meet commercial thresholds.

This year, RudderStack and GrowthLoop appear as honorable mentions. Definitely well deserved, and worth paying attention to.

Not as a value judgment, but as a signal, although not necessarily 'agentification'... but I would be more than happy to discuss this sometime over beers 🍻

There’s a, what I like to call, shadow market around the Magic Quadrant. A space where teams experiment with warehouse-first activation, minimal context layers, and outcome-driven execution without committing to a full enterprise platform... and succeed.

I want to come back to that space separately. What sits just outside the quadrant often tells you where practitioners are heading before categories catch up.

Where CEPs quietly become the safer bet

This is where Customer Engagement Platforms re-enter the picture for many mid-market teams.

Not as stand-ins for CDPs. Not as cheaper versions. Simply as systems that made narrower promises from the start and that resonated significantly with marketing teams and their budgets.

CEPs focus on execution. Multiple channels. Feedback loops. Clear ownership. Increasingly, AI features that live inside a known surface instead of across the entire organization.

In my client work throughout 2025, I’ve seen more willingness to commit to CEPs with AI capabilities than to CDPs, even when teams fully understand the long-term value of stronger data foundations.

"Why?" I hear every Customer Data Platform fanperson ask...

Because CEPs deliver visible impact without forcing an organizational redesign upfront. CDPs often ask for that redesign before the benefits show up. Something I always referred to as its indirect impact on profit and loss (P&L). It is just a fact of life, often one that works against its true benefits.

Was this really a choice?

It’s tempting to describe this as buyers choosing CEPs over CDPs.

That framing puts too much weight on preference and not enough on constraints.

As the CDP category matures and splits, it optimizes around organizations that can sustain its assumptions. Others move toward tools that fit how they already work, not how they aspire to work one day. Transformation anyone?

The mid-market didn’t vanish down some deep black hole. It had a 200 IQ moment and followed the path of least organizational friction.

Reading the MQ through a practitioner lens

From a practitioner point of view, this also helps explain the mixed reactions to the Magic Quadrant itself.

Not outright rejection. Not mere indifference. Although it thread the needle.

The Magic Quadrant still helps with orientation in places. It shows direction. It shows momentum. In some cases it opens doors in regions where "Quadrant = Life". What it struggles to show is effort. The day-to-day cost of implementation, coordination, and governance once the decision is made.

That’s why some people still study it closely, some glance at it and move on, while others rip it apart or praise it all the way on LinkedIn.

Closing the loop and part 2

In part 1, I argued that the CDP category didn’t suddenly become clearer this year. It became more explicit about its internal split.

This second part adds something intrguing. When categories sharpen, consequences follow. And in my opinion, opportunities are created in the void that is left behind.

Markets grow up. Competition hardens. And some buyers find themselves just outside the frame because the picture changed... again.

I’ve spent less time asking which vendor wins for a while now. The more interesting question is who each category stops serving, and what grows in the space that opens up.

That’s usually where the next shift starts. What will it be this time?

Your stack isn’t failing.

It’s absorbing more effort than it used to.

The Second Law of Martech scan helps you see where organisational energy is being spent just to keep things working, and where that cost is starting to crowd out real value.

Discussion