For most of the last decade, Customer Data Platforms (CDPs) and Customer Engagement Platforms (CEPs) have been sold as enterprise transformation tools. Big budgets, big integrations, big promises. But as we move toward 2026, the energy in that market seems to be changing course. Enterprise demand is flattening, and the next wave of growth is forming lower down the ladder, in the restless, pragmatic mid-market.

The state of play

Depending on whose model you trust, or whose newsletter you have subscribed to, the global CDP market will sit somewhere between $7.5 and $9.7 billion by 2025, growing at roughly 20 to 27 percent annually through the rest of the decade. Add the CEP and multichannel marketing hub categories, and you get a combined segment already worth $13 to $15 billion. That’s impressive to say the least, but the story underneath the averages tells us more.

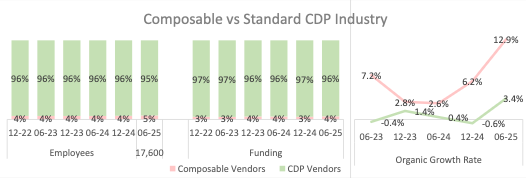

To crunch a few numbers, the CDP Institute now tracks nearly 190 active vendors, supported by roughly 17,000 employees (report). Gartner’s 2024 Magic Quadrant, meanwhile, lists only seventeen players large enough to qualify. It’s a good snapshot of how crowded and mature the enterprise end of the market has become. Adobe, Salesforce, and Tealium have claimed their share. Twilio, Treasure Data, and many more occupy the rest. The bucket, for the most part, is full.

Public data makes this visible. Salesforce’s Marketing Cloud Marketing Cloud Engagement revenue growth has slowed to single digits. Adobe’s Experience Cloud floats around ten percent. In addition to Customer.io's news above, Braze, one of the more agile CEPs, reported $593 million in revenue last year and guidance that points to steady but not explosive growth. Iterable sits above $200 million ARR (2024). These aren’t early-stage curves anymore, and it would be naive to think so. They’re at a minimum mature-market lines.

And beneath all of that maturity, fewer than five percent of vendors identify as “composable” or “warehouse-native.” That’s where the next story begins.

The enterprise plateau

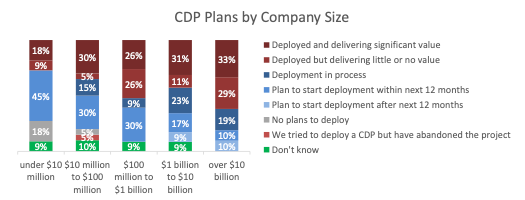

Enterprise organizations have, frankly, already bought their way into the CDP category. Between 2020 and 2024, implementing a customer data platform became a strategic checkbox, not just beer talk on a Friday afternoon. Every large brand either purchased one, built its own, or embedded similar functionality into a data warehouse. Adoption isn’t the challenge anymore. Their focus is on utilization and consolidation.

Roughly 70 to 75 percent of global CDP and CEP revenue still comes from enterprise accounts, but growth has slowed to around 8 percent CAGR. Sales cycles regularly stretch past six months, implementation costs exceed software costs, and the ratio of services to software can reach sixty percent. Most of the innovation dollars have moved to cost optimization or AI integration rather than expansion.

At this point, the enterprise story isn’t about opportunity any more than it is about endurance. Mergers will thin the vendor ranks by a quarter before 2026, because let's face it, consolidation is inevitable when everyone’s fishing from the same pond.

The mid-market window

The more interesting motion is happening below the Fortune 500. Mid-market companies, those with revenues between ten million and one billion dollars, are starting to behave like the enterprises of five years ago. They’ve matured enough to need data centralization, orchestration, and automation, but they’re still nimble enough to make decisions quickly.

There are around 200,000 such firms in the United States, and the OECD suggests the global total is well above 700,000. Even if only ten percent adopt a CDP or CEP at an average annual contract value of $120,000, that’s an $8-billion U.S. opportunity before you start to count Europe or Asia.

What makes the mid-market attractive isn’t just its size. These companies close deals in under ninety days. Their implementations are faster, their dependency on professional services is lower, and their internal politics are almost nonexistent compared to enterprise marketing teams. They buy based on fit and outcome, not procurement policy.

IDC’s mid-market studies show Martech investment growing 25 to 30 percent faster than enterprise IT spend. In other words, they’re the right customers at the right moment, ambitious, under-served, and impatient.

My 2026 predictions

If you project forward a year, the curve looks clear. Enterprise growth will hover around eight percent CAGR, while the mid-market share of new bookings rises from roughly a quarter today to about thirty-eight percent by the end of 2026. The venture climate may cool, but the companies that do emerge will be aimed squarely at this segment. Probably one in four new Martech vendors will design specifically for mid-market buyers.

Deal sizes will come down, around twenty percent lower on average, but payback periods will shorten dramatically. A typical CDP deployment that once took nine months can now go live in half that time. Payback within twelve to eighteen months is becoming the new benchmark, and vendors are learning that smaller deals done faster can compound just as efficiently as long enterprise pursuits.

Existing enterprise players will follow the signal. Roughly a quarter of them will release lighter, modular versions of their platforms priced below $250,000 in annual value. Most of these will appear through cloud marketplaces or as Snowflake-native apps, low-touch, self-serve, and partner-friendly.

And the product boundary between CDPs and CEPs will continue to blur. By 2026, about forty percent of CDPs will include core engagement features like journey orchestration, AI-driven triggers, or outbound connectors. The CEP world will evolve in parallel, strengthening its identity and segmentation layers. What was once two categories will increasingly operate as one data-activation stack.

From my podcast archive: Klaviyo's James Fang

What vendors should take from this

The next eighteen months won’t be about chasing bigger logos. They’ll be about right-sizing complexity. Vendors that learn how to package enterprise-grade capability into mid-market-ready form will gain the upper hand.

That starts with product design. Platforms need clear entry tiers that speak directly to companies of a few hundred employees, not a few thousand. Integration must default to the modern warehouse, Snowflake, BigQuery, Redshift, because that’s where mid-market data now lives.

Don't underestimate the need for (near) real-time capabilities. AI will be most useful not as a feature badge but as a setup accelerant for actions like automated data mapping, onboarding, and use-case scoring that turns months into weeks.

Compliance, too, needs simplification. Mid-market buyers care deeply about GDPR, CCPA or PDPL (enter random 4-letter acronym 😅) but don’t have legal departments to translate them. Vendors that can make privacy visible and usable will win trust quickly. And finally, partnerships need to scale down, not up. The real influence in this tier lies with boutique agencies and regional system integrators, not global consultancies.

The numbers behind the narrative

If you zoom out, the pattern is easy to see. Combined CDP and CEP revenues should rise from about $15 billion in 2024 to somewhere near $22 billion by 2026, a healthy twenty-plus percent compound rate. Enterprise will still represent the majority, but its share of total revenue will slide from around seventy-two percent to roughly sixty-two. Vendor count will tick slightly downward as consolidation plays out, while the share of composable or warehouse-native models doubles from five to twelve percent.

It’s not disruption so much as redistribution. Basically growth energy migrating from the top of the pyramid to its middle layers.

A field note from the trenches

In my own consulting work, that change is already visible. Enterprise projects feel more like upkeep, governance reviews, data model audits, incremental integrations. The mid-market clients, by contrast, are building momentum. They’re running smaller but cleaner stacks, making faster decisions, and treating CDPs not as transformation trophies but as practical accelerators. The budgets may be smaller, but the intent is much sharper.

The 2026 takeaway

By the end of 2026, the same acronyms will still dominate Martech conversations, (Composable) CDP, CEP, DWH, but the gravity will have changed. Enterprise adoption will be stable but slow. Mid-market expansion will account for the majority of net-new growth. And the vendors who adapt their go-to-market motion, pricing, and onboarding to serve that segment will own the next phase of the category.

The enterprise party isn’t over, but the playlist has definitely changed. The mid-market after-party is where the energy, and the opportunity, now lives.

What are you predictions for 2026? Leave a comment below 👇🏻

Discussion