Every week a new headline drops like a bomb. This company's app just killed another company's app, blew up something else, or declared the death of a technology category. As a military veteran, I find it strange how casually our industry borrows the language of conflict. There’s enough of that in real life.

Take Customer Data Platforms. Depending on who you follow, CDPs are either dead, obsolete, or absorbed beyond recognition. But as Brian Blessed once roared in Flash Gordon, “GORDON’S ALIVE!”

If he worked in martech, he’d be shouting, “CDP’S ARE ALIVE!”

Because they are. Their heart now beats inside Customer Engagement Platforms, their brain is wired into data warehouses, and their lungs are keeping composable stacks breathing. But let’s be honest: those organs weren’t exactly donated. They were copied, absorbed, sometimes stitched in with marketing-friendly labels. CEP vendors saw the value of unified profiles and real-time activation, and they built versions of those features into their own products. Data warehouses did the same by working closely with composable solutions. What looks like category death is really category diffusion.

Enterprise versus the rest

So why the constant chatter that CDPs are finished? Most of it comes from enterprise IT and data leaders who’ve shifted toward composable architectures. They have the engineering depth to use Snowflake or BigQuery as the hub, plug in activation tools, and call it a day. In that context, a packaged CDP feels redundant. But this story doesn’t translate to the mid-market.

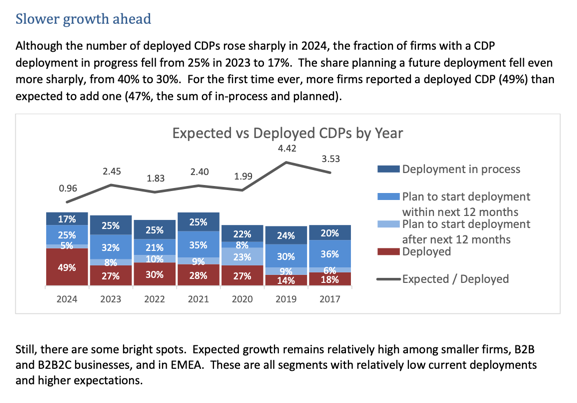

For small and mid-sized businesses, the picture looks very different. Adoption is still climbing. The CDP Institute’s most recent survey shows mid-market firms expect above-average new deployments, while the enterprise segment is flattening after earlier adoption waves.

Why? Because mid-market teams don’t have ten engineers to maintain pipelines or a seven-figure budget for data infrastructure. They want solutions that hide complexity, control costs, and deliver fast ROI.

And this is the nuance that gets lost. The mid-market doesn’t care about category labels. They care that the functions exist, that they’re accessible, and that they fit their growth path. If those features live inside a CEP like Braze, Iterable, Bloomreach, ZEPIC, or Klaviyo, that’s fine. If they come packaged in a hybrid CDP with managed services, that works too. The “death” narrative is a distraction from the real question:

Where do you want those vital organs, those core features, to live?

My 2 cents

For buyers, the takeaway is simple. Ignore the hype cycle headlines. Focus on the functions: data collection, unified profiles, consent management, segmentation, personalization. If your current team can’t maintain a composable stack, don’t force it. If you’re growing fast and have technical depth, maybe you leapfrog directly to a warehouse-native approach. Either way, measure success by outcomes, not by whether you’re aligned with the latest analyst soundbite.

For vendors, there’s a lesson too. CEPs shouldn’t pretend their CDP-like features are revolutionary. They were borrowed, and that’s okay, but market them honestly, as growth enablers for mid-market teams who can’t justify complexity. CDPs, on the other hand, should own the fact that their best features were valuable enough to be copied. It is not necessarily a weakness, but more proof of it’s relevance. The challenge now is to explain why you still deliver those features better, especially for customers who don’t have enterprise-sized resources.

Don't believe the hype

So no, CDPs aren’t really dead. Their features live on, transplanted, copied, sometimes outright stolen. The need for unified customer data is very much alive, especially in the mid-market.

As mParticle's Michael Katz and Jason Lynn put it:

As foundational CDP features are commoditized, the challenge for CDPs to differentiate themselves will revolve around how well they can address the "big challenges" in using customer data to solve marketing problems.

That's why, in the next piece, I’ll turn to the mid-market and what adoption looks like today, the constraints these businesses face, and how they can focus on the quick-win use cases that prove ROI.

And if you’re already feeling stuck between hype and reality, this is exactly where structured advisory and RFP guidance can save you from expensive mistakes. That’s the work I spend most of my time on with clients.

Discussion